Creating an Effective Budget

With the way that the economy is these days, it is extremely crucial to produce a budget plan that you can stick to. Rates remain to get on the surge, as well as unemployment rates remain going up also. With this, you must consider sticking to a household spending plan in order to help you obtain prepare for the future. Save cash as you go, as well as you will remain in a better position later on down the road. While almost everyone can agree this is a good idea, it constantly seems harder actually. Thankfully, adhering to a spending plan does not need to drive you crazy.

Generally, people make enough money to get by. For lots of people, it is not being able to handle their money correctly that is the issue. When this takes place, then you make sure to locate that planning what you will do with your money will certainly be a very effective point when assisting your household economically. Keeping an eye on everything is the primary step.

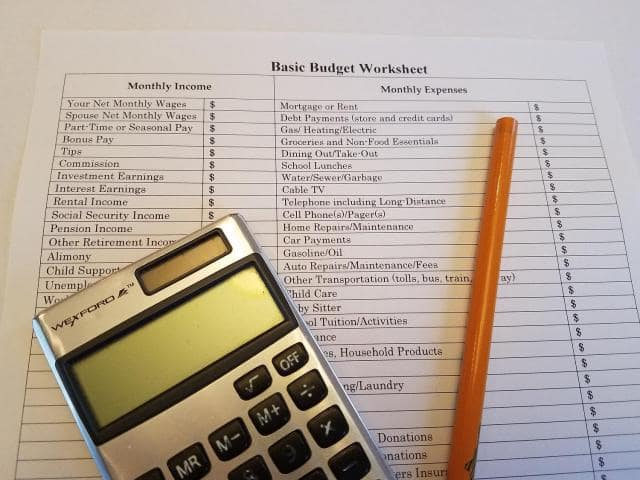

When you are developing an efficient spending plan, you must put in the time to recognize how much cash you are making knowledgeable about how much money you are investing. When you check out methods to make an excellent budget, you will intend to make sure that there is even more money being available than there is going out. You will additionally intend to take a look at various means to reduce your spending in order to offer you the very best possible outcome in the future later on.

The first thing that you need to budget plan is the essential things such as food, clothing, shelter as well as auto expenses. These are points that you can not perhaps live without. Regardless of what, these points will need to be paid, as well as must therefore be a concern to you. Put them on top of your spending plan. If there is any way that you can cut down on these prices, do so.

For instance, with gas money, if you do not need to make unneeded journeys you need to refrain from doing so. You can likewise cut back on your food costs by going shopping better as well as dining in a restaurant much less. The even more food preparation you do in your home- the better off you will be financial. If you want to find great information, check these guys out to learn more.

The extra things that you acquire as well as do every month should be limited. You should refrain from doing a lot of unneeded costs if you do not need to. Reducing unneeded investing is a great way to ensure that you will have extra money to take into your savings account. Doing this will certainly offer you a lot of adaptabilities when times obtain tough. You can draw on this cost savings fund in case of an emergency situation as well. With the economic situation in a slump, there is no informing what may occur.

Put in the time to list every little thing that you acquire to ensure that you have the ability to track where your cash is going. Oftentimes, if you have a look at where your money is going you will certainly be far better able to spend more successfully. For example, if you look back as well as see that you spend numerous dollars dining in restaurants when you really did not need to, you might be much more mindful concerning this in the future.